Adding loyalty cards to Apple and Google Wallet is a simple way to improve customer convenience and engagement. By replacing physical cards with digital ones, businesses save on printing costs, reduce waste, and gain better insights into customer behavior. Customers benefit from real-time updates on rewards, easy access to their cards, and a hassle-free way to participate in loyalty programs.

Here’s what you need to know:

- Apple Wallet: Requires an Apple Developer account and uses the PassKit framework to create digital passes. Cards are stored in PKPass files and can include features like push notifications for updates.

- Google Wallet: Starts with a Google Wallet API Issuer account. Cards can be distributed via apps, websites, or emails and must follow Google’s specifications for design and functionality.

- Design Tips: Use your brand’s logo, colors, and clear instructions. Include a scannable QR code or barcode for easy use at checkout.

- Distribution: Share cards through email, SMS, social media, or in-store QR codes. Train staff to assist customers with adding cards to their wallets.

Digital loyalty cards don’t just simplify the process – they can drive repeat visits and higher spending. Businesses like Maria’s Bakery saw a 34% increase in repeat customers after launching their digital program. Testing and regular updates are key to ensuring a smooth and engaging experience for customers.

How To Add Loyalty Cards In Apple Wallet – Full Guide

Getting Ready for Loyalty Card Integration

Before diving into the technical setup, it’s crucial to lay the groundwork for integrating loyalty cards with Apple Wallet and Google Wallet. Each platform has its own set of requirements and approval steps to ensure your loyalty cards work seamlessly and comply with their standards. This preparation connects your overall strategy to the technical steps that follow.

Apple Wallet Requirements

To start with Apple Wallet, you’ll need an Apple Developer account. This account is essential for creating and distributing digital passes. Every pass must be signed with a certificate issued by Apple and linked to your developer account. Additionally, these passes can only be accessed through apps developed by your team with the correct entitlements.

The backbone of Apple Wallet integration is the PassKit framework. This tool handles everything from pass creation to real-time updates via push notifications, which help keep customers informed about their rewards and special offers.

If you’re planning to offer Apple Pay contactless passes, you’ll also need an NFC certificate and must certify three key components: your passes, payment terminals, and POS software.

When submitting your app, ensure it includes valid contact details for the issuer and is signed with a dedicated certificate tied to the brand or trademark owner of the pass. Apple reviews every app submission for security, scanning for malware and privacy risks. Don’t forget to review the Apple Pay Marketing Guidelines to ensure your promotional materials meet Apple’s standards.

Google Wallet Requirements

For Google Wallet, the process begins with creating a Google Wallet API Issuer account. The setup may vary depending on your development approach. Non-Android developers will need a Google Cloud account, while Android developers must configure Google Play services to access the required APIs.

The Google Wallet API offers flexibility in distributing passes. You can share them through Android apps, websites, email, or even SMS. However, you’ll need to follow Google’s pass specifications closely. Additionally, Google places a strong emphasis on data protection, including compliance with regulations like GDPR, so make sure your data handling practices are up to par.

Collecting Assets and Planning Your Program

Before designing your digital loyalty cards, gather the necessary visual assets for each platform. Apple Wallet and Google Wallet have different specifications, so creating separate versions is a must.

| Platform | Asset Type | Requirements | Purpose |

|---|---|---|---|

| Google Wallet | Logo | PNG, 660px by 660px, 1:1 aspect ratio | Shown on the card front; masked into a circle |

| Google Wallet | Hero Image | PNG, 1032px by 336px, 3:1 aspect ratio | Displayed when card details are viewed |

| Apple Wallet | Icon | PNG, 29×29 points, 1:1 aspect ratio | Used for change notifications |

| Apple Wallet | Logo | PNG, max 160×50 points | Appears in the top right corner of the card |

For Google Wallet logos, remember they’ll be masked into a circular shape. To avoid cutting off key elements, include a 15% margin and leave the logo in a square format with a full-bleed background color.

Next, define straightforward rules for earning and redeeming points, along with clear eligibility conditions. Keeping these rules simple and appealing encourages customer participation.

It’s also important to address legal and privacy concerns, such as GDPR compliance.

Using a loyalty platform can simplify the process of creating and managing digital loyalty cards. For instance, tools like meed (https://meedloyalty.com) provide pre-designed templates that align with Apple and Google’s guidelines, making setup much easier.

Planning pays off. Take Maria’s Bakery as an example: after launching their digital loyalty card, they saw a 34% boost in repeat customers within three months, alongside a 22% increase in average order value from loyalty members. Even more impressive, 88% of their customers preferred the digital card over the old paper punch card system.

Once your assets are ready and your program rules are defined, you’re set to move on to the step-by-step process of creating your digital loyalty cards.

How to Add Loyalty Cards Step by Step

Both Apple Wallet and Google Wallet provide efficient ways to engage your customers and keep track of their participation in your loyalty program.

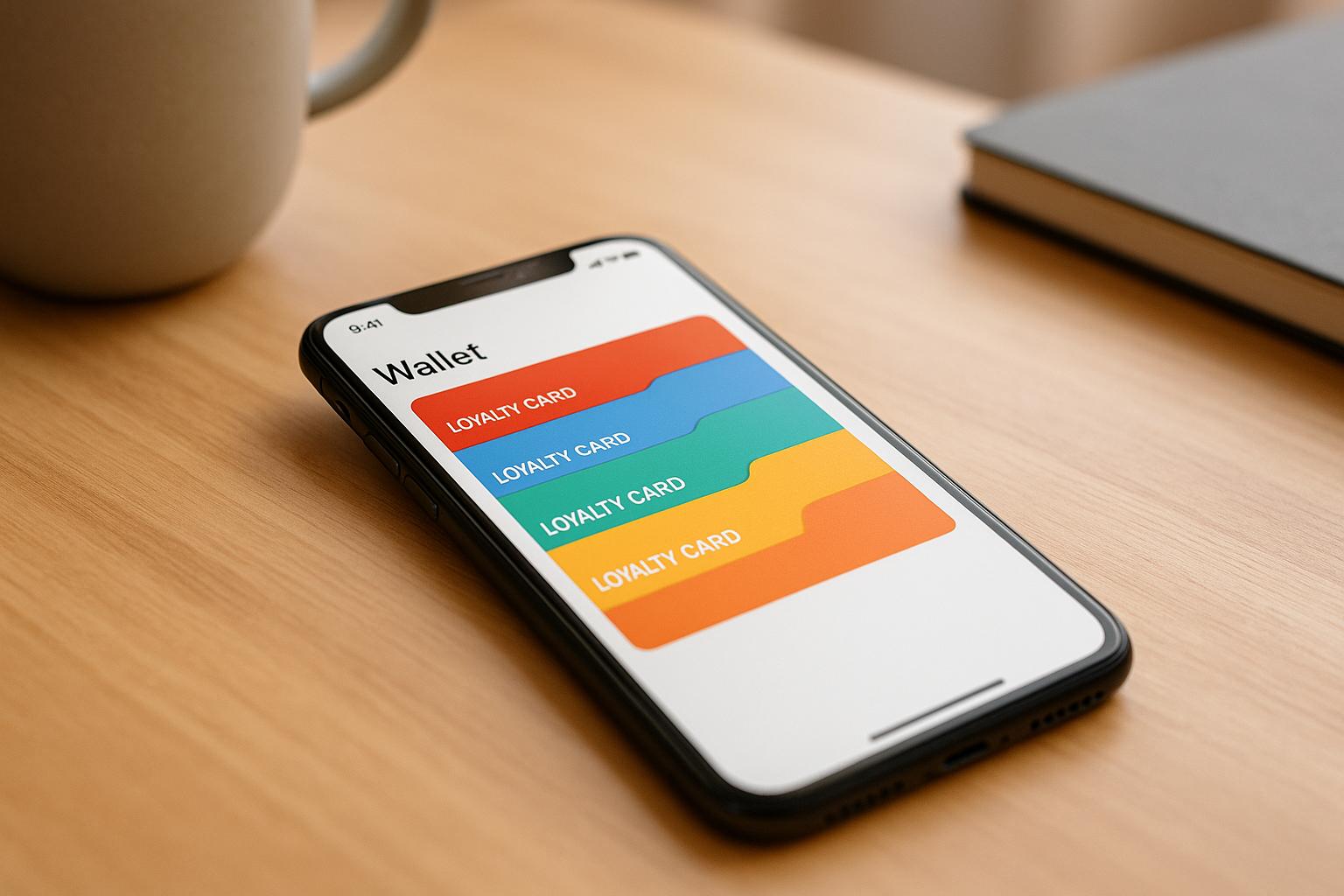

Designing Your Loyalty Card

Think of your loyalty card as a digital extension of your brand. It should not only look polished but also clearly showcase the benefits of your program. Start by selecting a template that aligns with your business and the goals of your loyalty program.

To make it memorable, incorporate your logo, brand colors, and other key visual elements. Personalize the card by including essential details like the customer’s name, membership status, and current tier points. This gives the card a tailored feel.

Make sure the card explains how rewards are earned and redeemed. A scannable QR code or barcode is a must for tracking, so ensure it’s large enough to scan easily, even in dim lighting.

Before finalizing, test the design on different screen sizes. Most customers will access their loyalty cards on smartphones, so double-check that everything looks sharp and is easy to read across devices.

"A well-designed loyalty card communicates your brand’s values and the perks you provide to your customers".

Once your design is ready, it’s time to create the digital version for Apple Wallet and Google Wallet.

Creating Apple Wallet Cards

With your design complete, the next step is to build your Apple Wallet cards. This requires using the PassKit framework, which handles the creation and updates of digital passes. If you don’t already have an Apple Developer account, you’ll need to set one up – it’s a prerequisite for creating and distributing passes.

Apple Wallet cards are stored in PKPass files. These files combine the design, customer details, and functionality of the card. The format relies on JSON to define fields, styling, and behavior, and it includes image assets that must meet Apple’s size specifications.

Set up fields for key information like member details, point balances, and scanning options. Apple Wallet supports various barcode formats – such as QR codes, PDF417, and Aztec codes – so select the one compatible with your point-of-sale system.

To keep customers engaged, enable push notifications for updates like new rewards, expiring points, or special offers. Just be mindful not to overdo it – too many alerts can annoy users.

Before launching, test your passes on multiple iOS devices. This ensures everything works smoothly and reduces the chances of delays during Apple’s review process.

Creating Google Wallet Cards

Once your Apple Wallet pass is ready, you can move on to creating a Google Wallet version. Start by registering for a Google Wallet API Issuer account. The setup process may differ slightly depending on whether you’re developing for Android alone or creating a cross-platform solution.

Use the Google Wallet API or SDK to develop card objects that include all the details of your loyalty program. Google’s system is flexible, allowing you to distribute the cards through Android apps, websites, emails, or text messages.

Add merchant details like your business name, location, and contact information to establish trust and make customer support easily accessible. Be sure to include clear terms and conditions for your loyalty program.

Design the card according to Google’s specifications. Keep in mind that logos are displayed within a circular frame, so leave enough margin to avoid cutting off key elements.

Finally, test the card’s functionality across different Android devices and Google services to ensure everything works seamlessly, whether customers access the card through the Wallet app, Google Pay, or your website.

Using a Loyalty Platform to Simplify the Process

If the technical details feel overwhelming, consider using a loyalty platform to simplify the process. These platforms handle the complexities of integrating with Apple and Google Wallets and provide tools to manage your loyalty program more effectively.

Platforms like meed offer pre-designed templates that automatically meet the specifications for both Apple and Google Wallets. This eliminates the hassle of adjusting image sizes, field placements, and other technical requirements, allowing you to focus on perfecting your card’s appearance and rules.

Many loyalty platforms also include analytics and customer management tools. These features can help you track redemption rates, measure customer engagement, and calculate the ROI of your program.

Managing updates across both platforms becomes much easier with a loyalty platform. Instead of juggling separate systems, you can make changes from a single dashboard.

For example, in 2021, Necoffee leveraged a loyalty platform and saw its average purchase value jump by 26%. This shows how a streamlined digital loyalty program can directly impact your business’s bottom line.

Testing and Launching Your Digital Loyalty Cards

Once your loyalty cards are ready for Apple and Google Wallet, the next step is crucial: thorough testing. This stage ensures your program works seamlessly, avoiding technical hiccups that could frustrate users and harm your brand.

Testing on Different Platforms and Devices

Start with internal testing. Have your team add the cards to their wallets and simulate transactions to identify any glitches. Test basic functions like adding the card, checking point balances, and scanning QR codes at checkout.

Next, invite a select group of loyal customers or volunteers to test the cards. Their feedback can reveal usability issues – such as unclear instructions or a confusing design – that internal testers might overlook.

Make sure to test across a variety of iOS and Android devices, taking into account different screen sizes, lighting conditions, and transaction scenarios. Simulate real-world use cases, like earning points, redeeming rewards, and handling expired points, to confirm everything works as intended.

Security checks are also essential. Ensure card data is encrypted and protected from unauthorized access or tampering. This step reassures users that their information is safe.

Pay attention to how testers interact with the cards. If they struggle to understand how to earn or redeem points, consider simplifying the design or clarifying instructions. If you expect a large number of users at launch, conduct load testing to confirm your system can handle high traffic without crashing.

Once you’ve resolved any issues and confirmed the cards are reliable, you’re ready to roll them out to your customers.

How to Share Loyalty Cards with Customers

After testing, it’s time to distribute your loyalty cards. Use multiple channels to reach your audience effectively.

- Email and SMS: Send personalized messages to your customers with direct links to add the loyalty card to their wallets. Highlight the benefits and include clear instructions.

- Social Media: Announce your loyalty program on platforms like Instagram, Facebook, and Twitter. Share posts that explain the perks and demonstrate how easy it is to use the card.

- Receipts: Add QR codes or links to printed receipts, giving customers an easy way to join your program right after a purchase.

- In-App and Website Promotions: Feature banners or buttons on your app or website that allow users to enroll with a single tap. If you have a mobile app, integrate the loyalty program into the user experience for a seamless process.

- NFC Terminals: If your checkout system supports NFC, let customers tap their phones to enroll during checkout.

Don’t forget to train your staff. Equip them with the knowledge to explain program benefits and assist customers in adding cards to their wallets. A well-informed team can make a big difference in driving sign-ups.

Maintaining and Updating Your Cards

Keeping your loyalty program fresh is key to maintaining customer engagement. Recent data highlights that loyalty engagement is declining, with over 35% of consumers planning to cancel memberships in the next year. Younger audiences, particularly those aged 18–34, are even more likely to leave.

Use analytics and customer feedback to refine your program. Tailor rewards and offers based on purchase history and preferences. This personalized approach can help retain customers, especially since many are now more likely to switch to competing programs than they were a few years ago.

Regular updates to your program are essential. Adjust rewards structures, tweak point values, or introduce limited-time promotions based on performance data. These changes keep your program relevant and appealing.

Stay on top of platform updates from Apple and Google Wallet to ensure compliance and prevent disruptions. Proactively adapting to changes avoids frustrating your customers.

Lastly, keep your members engaged through push notifications, emails, and in-app messages. Share updates about new rewards, expiring points, or exclusive offers, but avoid overwhelming them with too many messages. Consider adding perks beyond discounts – like early access to products, invites to special events, or exclusive content – to build stronger emotional connections with your audience.

sbb-itb-94e1183

Best Practices for Better User Experience

Once your digital loyalty cards are up and running, the next step is to fine-tune the experience. A great loyalty program does more than just place cards in mobile wallets – it creates a seamless and engaging journey for your customers.

Branding and Customization

Your loyalty card often serves as a customer’s first digital interaction with your brand, so it’s essential to make it feel like a natural extension of your identity. Use your brand’s colors, fonts, and logo to ensure consistency. This not only reinforces your branding but also builds trust.

Highlight key details – like point balances or membership tiers – right on the front of the card for easy access. Save terms and conditions or additional details for the back or within expandable sections. Keep your tone consistent with your brand’s personality – whether that’s fun and playful or sleek and professional. You can also update the card’s design for holidays or special promotions to keep things fresh while staying true to your brand’s core look.

Providing Clear Instructions to Customers

Even the best-designed loyalty program won’t succeed if customers are confused about how to use it. Make sure every call-to-action for joining your loyalty program is paired with straightforward instructions. Use channels like email campaigns or a dedicated section on your website to explain the benefits – such as real-time updates on points and rewards – and guide customers through the enrollment process step by step.

Offer multiple ways for customers to access your loyalty cards. Whether it’s through in-store displays, print materials, SMS, email, or social media, meet your customers where they’re most likely to engage. Additionally, train your staff thoroughly so they can assist customers with any questions. Clear communication from the start sets the stage for a better user experience and helps you gather valuable feedback for future improvements.

Using Analytics to Improve Your Program

Data is your best friend when it comes to refining your loyalty program. As Peter Drucker famously said, "If you can’t measure it, you can’t manage it". Focus on metrics like customer retention and purchase behavior. Studies show that even a 5% increase in customer retention can lead to a profit boost of 25% to 95%. While general retention rates hover between 70% and 80%, repeat purchase rates in e-commerce tend to range from 20% to 40%.

For example, a Shopify Plus brand using Growave saw a 48% returning customer rate, and customers redeeming rewards generated twice the revenue of non-redeemers. Tools like meed’s analytics dashboard make it easier to track these trends, helping you identify which rewards resonate most with your audience. Plus, since 88% of people trust a brand more after a recommendation from someone they know, keeping an eye on word-of-mouth referrals is critical.

Conclusion

Loyalty cards for Apple and Google Wallet have revolutionized how businesses connect with their customers. By streamlining the process – from setup and design to testing and launch – digital loyalty programs outperform traditional punch cards in every way.

The numbers speak for themselves. Boosting customer retention by just 5% can lead to a profit increase of up to 95%. Loyal customers, on average, spend 67% more than new ones, and retaining them is five times cheaper than acquiring new ones. Furthermore, 75% of customers are willing to switch brands for a better loyalty program, and 73% actively seek opportunities to redeem rewards.

The impact of loyalty programs doesn’t stop there. Sixty-six percent of customers admit that earning and using rewards influences their spending habits. For businesses, this translates to a revenue increase of 15% to 25% when customers engage with a loyalty program. Digital loyalty cards also eliminate the hassle of physical cards while offering real-time updates, making the experience seamless and convenient.

"Digitalization is replacing traditional card-based models with app-integrated programs that integrate with e-commerce and digital payments. This enhances customer convenience and experience, while providing richer customer data for companies. In the coming years, technologies such as blockchain, augmented reality/virtual reality, omnichannel integration and, of course, artificial intelligence (AI) will also heavily impact loyalty programs." – Arjun Vir Singh, Partner, Arthur D. Little

To get the most out of a digital loyalty program, businesses need to prioritize careful planning, rigorous testing, and continuous optimization. Clear communication, consistent branding, and leveraging analytics to refine the program over time are key. Whether you opt to build a custom integration or use platforms like meed to simplify the process, investing in digital loyalty cards can lead to stronger customer relationships, higher spending, and long-term growth.

FAQs

What are the benefits of using digital loyalty cards in Apple Wallet and Google Wallet for businesses and customers?

Digital Loyalty Cards in Apple Wallet and Google Wallet

Digital loyalty cards in Apple Wallet and Google Wallet bring plenty of perks for both businesses and their customers.

For businesses, these cards simplify managing loyalty programs. They make it easy to create, customize, and integrate rewards directly into mobile wallets. This not only helps increase customer engagement and retention but also cuts costs tied to printing and distributing physical cards. On top of that, going digital means using less paper and plastic, aligning with eco-friendly practices.

For customers, the convenience is hard to beat. They can keep all their loyalty cards in one place, access rewards effortlessly, and get real-time updates. The contactless feature also speeds up transactions and adds an extra layer of security, making shopping smoother and safer.

How can businesses make sure their loyalty cards meet Apple and Google Wallet requirements?

To make sure your loyalty cards work smoothly with Apple Wallet, stick to Apple’s guidelines for creating passes. This includes meeting their security requirements and respecting user privacy standards. Additionally, ensure the cards are updated to support the latest features and comply with any relevant local regulations.

For Google Wallet, follow their API standards for loyalty cards, focus on protecting user data, and adhere to Google’s policies for managing passes.

Both Apple and Google stress the importance of data protection, user privacy, and following industry standards like PCI DSS. Take the time to thoroughly test your loyalty cards on both platforms to guarantee a hassle-free experience for your customers.

How can businesses effectively promote and share their digital loyalty cards with customers?

To effectively promote and share digital loyalty cards, businesses should prioritize creating an easy and engaging experience for their customers. One way to spark interest is by offering special perks, such as discounts or rewards, just for signing up. These incentives can make joining the program more appealing.

Accessibility is key, so make sure customers can easily find and use the program. Use in-store signage with QR codes to guide them, send tailored email campaigns to catch their attention, and leverage social media to spread the word. These strategies not only increase awareness but also simplify the process of adding loyalty cards to Apple or Google Wallet.

Lastly, encourage customer feedback and showcase success stories from happy participants. Sharing these testimonials builds trust and inspires others to join, helping your loyalty program gain traction and keep customers engaged.