Personalized rewards are the future of customer loyalty. They outperform generic programs in engagement, conversions, and sales. With tailored rewards, businesses can connect with customers on a deeper level, increasing retention and revenue. Here’s how:

- Why it works: Personalized rewards deliver 3.4x higher conversion rates and boost sales by 10%.

- What customers want: 73% of consumers prefer customized rewards, but only 45% of brands offer them.

- How to do it: Use zero-party (customer-shared) and first-party (behavioral) data like purchase history and preferences to create meaningful offers.

- Legal compliance matters: Follow privacy laws like GDPR and CCPA to build trust and avoid penalties.

- Tools to help: CRM systems, analytics dashboards, and loyalty platforms simplify data management and reward personalization.

Personalized Customer Loyalty at Scale with DSW (Cloud Next ’19)

Customer Data and How It Enables Personalization

Customer data forms the backbone of personalized rewards. Without insights into customer behavior, creating meaningful personalization becomes guesswork. In fact, 83% of consumers are willing to share their data in exchange for a personalized experience.

It’s best to start small when collecting data. You don’t need to bombard customers with lengthy forms right away. Instead, begin with the basics – like a name and email address – and build from there through ongoing engagement.

Types of Customer Data

Different types of customer data can fuel a personalized rewards strategy, but some are more valuable than others. Zero-party and first-party data are especially important because they are accurate and collected with consent.

- Zero-party data: This is information customers willingly share, such as their preferences, interests, or feedback obtained through surveys, quizzes, or direct interactions.

- First-party data: This comes from direct engagement with your brand, like purchase history, website activity, app usage, and customer interactions.

Examples of how brands collect this data include quizzes, receipt uploads, and purchase history initiatives from companies like Shop Premium Outlets, Life Nutrition, Black Box Wines, and Starbucks.

Among these, purchase history stands out as particularly valuable. It reveals patterns like seasonal preferences, price sensitivity, and product affinities. Starbucks, for example, uses purchase data to offer personalized rewards and recommendations, such as discounts on frequently purchased drinks.

Other helpful data includes demographic details (age, location, lifestyle) and behavioral insights (email open rates, browsing habits, social media engagement, and loyalty program participation). All of this contributes to building detailed customer profiles. However, data collection must align with strict privacy standards. Once these data types are understood, businesses can focus on legal compliance and effective segmentation.

Legal and Privacy Requirements

Handling customer data responsibly is critical. While loyalty programs often promise perks in exchange for data, this practice has come under increased regulatory scrutiny. Complying with privacy laws isn’t just about avoiding penalties – it’s about earning customer trust.

Loyalty program data falls under consumer protection laws like GDPR, PIPEDA, and various U.S. state privacy regulations. For example, California’s Consumer Privacy Act (CCPA) treats loyalty programs as "financial incentives", requiring clear disclosure of the incentive’s value, how it’s calculated, and a "Notice of Financial Incentive". Colorado’s Privacy Act goes further, mandating that data collected for loyalty programs must be strictly necessary for participation.

The risks of non-compliance are real. In early 2024, Marriott International and its subsidiary Starwood settled with the FTC over data breaches, which included specific requirements for their loyalty program.

To build trust, businesses should:

- Clearly explain data collection practices in privacy notices, detailing what data is collected, why it’s needed, how it’s used, and customer rights.

- Offer opt-out options and ensure consent is freely given, specific, and informed.

- Implement strong security measures, such as encryption, access controls, regular vulnerability scans, and vendor oversight.

Once you’ve established secure and transparent data practices, the focus shifts to organizing that data effectively.

How to Organize and Segment Data

Raw data without structure provides little value. Customer segmentation involves dividing your audience into distinct groups based on shared characteristics. This process transforms generic rewards programs into tailored experiences.

Segmentation enables businesses to customize rewards, communication, and marketing for specific groups. The impact is clear: companies that use segmentation see annual profit growth of 15%, compared to 5% for those that don’t.

Here’s how to get started:

- Collect data from sources like purchase history, browsing behavior, surveys, and CRM systems.

- Define segments aligned with business goals, such as increasing repeat purchases or improving loyalty program engagement.

Behavioral data often provides the most actionable insights. For instance, a luxury retailer discovered in October 2024 that customers who bought accessories were three times more likely to return within 30 days. Acting on this, they launched a targeted campaign offering bonus points for accessory purchases, which led to a 15% increase in repeat visits.

Common segmentation strategies include:

- Frequency-based groups (daily, weekly, or monthly shoppers)

- Spending tiers (high, medium, or low-value customers)

- Product preferences (most-purchased categories)

- Lifecycle stages (new, active, at-risk, dormant customers)

Segmentation also helps identify high-value customers and those at risk of leaving, enabling targeted retention efforts. For example, you could offer exclusive experiences to high-value customers and discounts to price-sensitive groups.

Remember, segmentation isn’t a one-and-done process. Regularly monitor segment performance and adapt to changing customer behaviors. As preferences evolve, your segmentation strategy should keep pace.

"Customer segmentation is the backbone of successful loyalty programs… tailoring rewards to specific customer groups can dramatically boost engagement and retention." – Reward the World™

With organized and compliant data, businesses can now leverage advanced tools to scale personalized rewards effectively.

Tools and Platforms for Managing Personalized Rewards

Turning customer data into tailored rewards is no longer just a luxury; it’s a necessity for brands aiming to stay competitive. Today’s loyalty platforms are far more advanced than the old point-tracking systems. They now process customer behavior in real time, delivering customized experiences on a large scale.

Key Technology Solutions

Personalized rewards programs thrive on three essential tech components: CRM systems, analytics dashboards, and loyalty platforms. Each plays a vital role in collecting, analyzing, and acting on customer data.

- CRM systems: These are the backbone of customer data storage, capturing everything from purchase history to preferences. They’re essential for spotting opportunities to personalize the customer journey.

- Analytics dashboards: Raw data becomes actionable insights here. Businesses that excel in using these tools to personalize experiences see up to 40% higher revenue.

- Loyalty platforms: These need to support flexible APIs, developer-friendly integration (think clear documentation, SDKs, and sandbox environments), and features for managing reward logic, validation, redemption, and tracking.

Security and privacy are non-negotiable. Platforms must comply with regulations like GDPR, CCPA, and PCI DSS to ensure data protection.

The best platforms offer diverse reward options, including free shipping, discounts, loyalty points, gift cards, cashback, and more. Features like milestone notifications, reminders for expiring rewards, and special promotions keep customers engaged. Additionally, businesses should have the flexibility to set custom rules and tailor rewards based on customer-specific data.

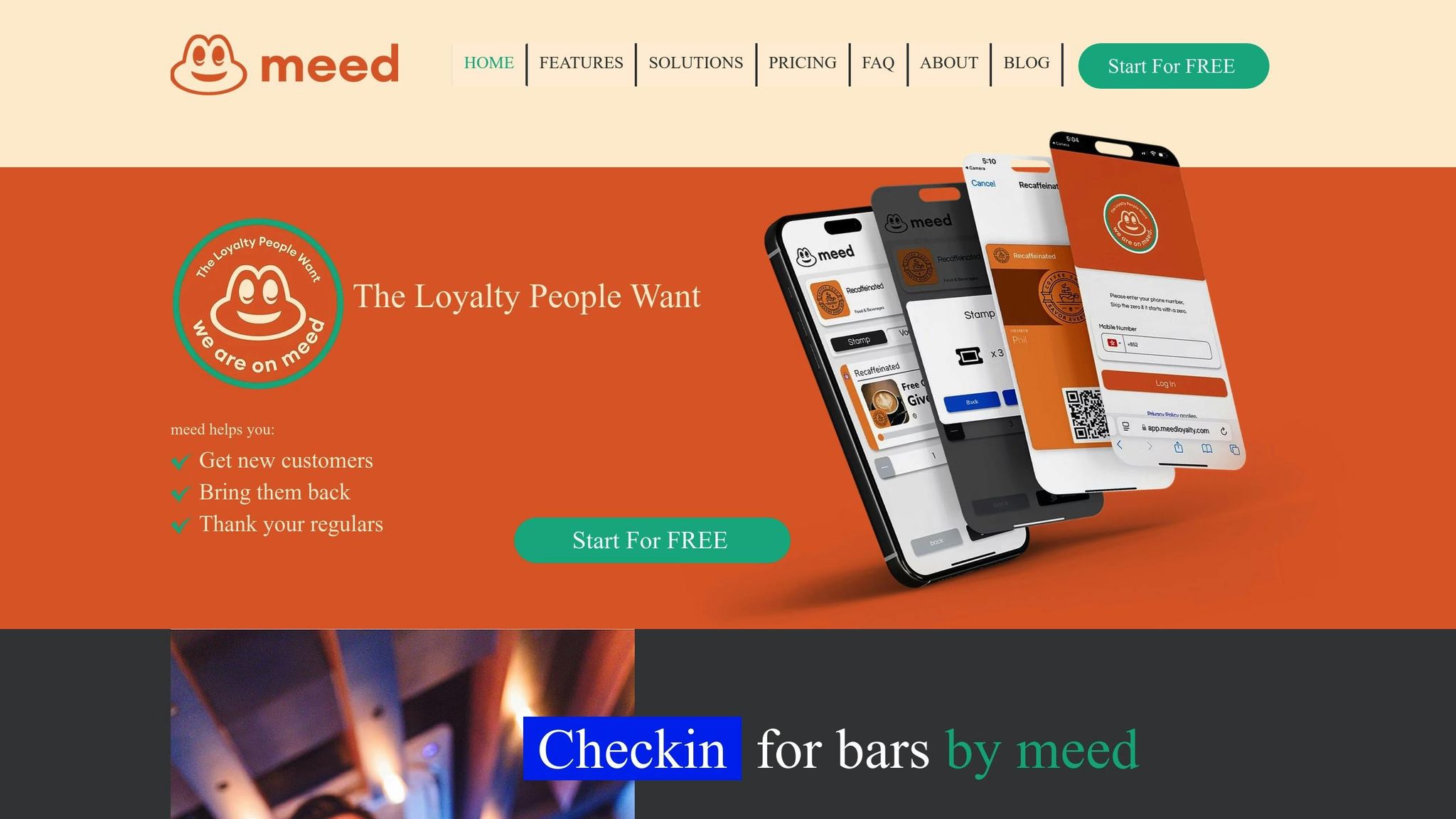

How meed Supports Personalized Rewards

meed leverages cutting-edge technology to simplify personalized rewards and enhance customer engagement. By integrating digital stamp cards, QR code rewards, and wallet features into one seamless platform, it creates a unified experience.

- Digital stamp cards: These track reward progress while capturing visit frequency and spending habits, feeding valuable data into personalization algorithms.

- QR code rewards: Quick to scan and easy to use, these allow customers to earn or redeem rewards instantly, making the experience smooth and engaging.

- Wallet integration: By syncing with Apple and Google wallets, meed ensures customers always have access to their rewards. This is crucial since 57% of loyalty members don’t know their points balance, and 38% are unclear on their points’ value.

The platform’s analytics dashboard is a game-changer, providing insights into participant activity, reward distribution, liabilities, expiry dates, shopping patterns, and campaign costs. This data empowers businesses to make smarter decisions about personalizing rewards.

meed also supports multi-location operations, ensuring a consistent and personalized experience across physical and digital touchpoints.

Multi-Channel Integration and Real-Time Data

The real magic happens when real-time data integrates across multiple channels. Companies that excel at omnichannel engagement retain 89% of their customers, compared to just 33% for those that don’t.

With real-time data synchronization, businesses can respond instantly. Whether a customer makes a purchase, browses a product, or hits a milestone, the system can trigger personalized rewards or messages on the spot. This immediacy enhances the overall customer experience.

Multi-channel loyalty programs connect all the dots, adapting to customer preferences and collecting real-time data to create tailored experiences. Whether through websites, apps, physical stores, or social media, customers feel recognized and valued wherever they interact with the brand.

The benefits of this approach are hard to ignore:

- Purchase frequency is 250% higher for omnichannel customers compared to single-channel ones.

- Average order values increase by 13% when customers engage across multiple channels.

- Companies using three or more channels in their reward programs see customer retention rates jump by up to 30%.

Personalized messages sent through multiple platforms also result in a 50% boost in response rates. This success comes from meeting customers where they are and delivering a consistent experience across all touchpoints.

A unified brand identity across channels strengthens these efforts. In fact, 68% of businesses report revenue growth when their branding is consistent. Whether customers receive personalized rewards via email, see them in a mobile app, or redeem them in-store, the experience should feel seamless and intentional.

Finally, frictionless redemption processes are essential. Whether rewards are accessed through push notifications, email campaigns, or in-app messages, the process should be effortless. Any barriers could discourage engagement with personalized offers.

While the tools for personalized rewards continue to evolve, one thing remains clear: using customer data to craft relevant, meaningful experiences is the key to building loyalty and driving engagement. Platforms that combine strong data capabilities, flexible reward options, and seamless multi-channel integration set the stage for success.

sbb-itb-94e1183

How to Create Personalized Rewards

After organizing customer data and choosing the right tools, the next step is designing rewards that truly connect with your audience. Personalized rewards need to adapt as customer behavior changes. Why? Because targeted campaigns can boost marketing ROI by up to 77% – showing just how much personalization can impact revenue. With solid data in hand, the focus shifts to using segmentation to craft tailored rewards.

Customer Segmentation for Targeted Rewards

Segmentation is where the magic happens. By analyzing purchase history, browsing habits, and customer preferences, leading brands deliver offers and messages that feel custom-made.

The payoff? Businesses using precise segmentation report annual profit growth of 15%, compared to just 5% for others. Plus, 73% of shoppers now expect personalized experiences, and 79% are more loyal to brands that deliver them.

"I strongly advocate programs whose cornerstone and standard mechanism is to reward the customer for each purchase behavior. This incentivizes the consumer to identify themselves as a loyalty program member with each transaction, as it brings them closer to the reward or other promised benefit. In turn, the brand gains the user’s entire purchase history, which allows for more accurate segmentation." – Monika Motus, Loyalty Expert, ex-Starbucks, ex-iSpot, ex-Douglas

Keeping your data fresh and reviewing it regularly is key to making segmentation work.

"You can have multiple client groups, depending on what purposes you want to use them for. These groups can be long-term segments that you use regularly or temporary ones specifically for events like winter holidays or Valentine’s Day." – Paweł Dziadkowiec, Loyalty Strategy Consultant, ex-BP

Dynamic Reward Structures

Once you’ve nailed segmentation, dynamic rewards can take personalization to the next level by adapting in real time. Unlike static rewards, which can feel stale, dynamic structures use live data to create offers based on behavior and context.

For example, instead of sending a generic discount, a customer who browses athleisure wear might receive a tailored offer like, "20% off your next activewear purchase". Tiered systems can also add excitement – customers who frequently redeem dining rewards might unlock higher-value perks over time.

Real-time rewards make things even more engaging. Imagine a coffee chain sending a discount notification when a customer is near one of its locations. Predictive personalization takes it further, suggesting timely offers based on past actions. Dynamic rewards can also drive cross-selling: if someone adds sneakers to their cart, a prompt like "Complete your look with these trending picks!" can enhance their experience. Tailoring rewards to specific industries, such as offering local incentives for distributors, adds another layer of relevance.

"When customers see their banking activities translated into meaningful value, engagement fundamentally shifts. Our data shows strategically aligned rewards can increase targeted behaviors. This requires diverse merchant partnerships that create personalized experiences – whether airline miles for travelers, restaurant cashback for foodies, wellness discounts for fitness enthusiasts, or geo-targeted offers like receiving a coffee shop discount after visiting a bookstore. These tailored connections don’t just reward transactions; they enhance lifestyles and cement loyalty in ways traditional banking incentives cannot match." – Mark Jackson, Managing Director, Valuedynamx

Using Customer Feedback to Improve Rewards

Personalization doesn’t stop at real-time adjustments – it’s an ongoing process. Customer feedback is essential for refining rewards and keeping them relevant.

Use surveys and redemption data to gather insights. Sometimes, actions speak louder than words; low redemption rates for certain offers can reveal preferences better than direct feedback. Being open about how you use customer data can also build trust and encourage more honest input.

Combining feedback with performance metrics ensures your rewards program evolves in a way that maximizes both customer satisfaction and business goals.

Measuring and Improving Personalization Results

To truly harness the potential of personalized rewards, tracking performance and making data-driven adjustments is essential. According to Forrester research, companies that emphasize customer engagement see 51% higher retention rates and 49% faster profit growth compared to their competitors. With 43% of marketers and IT leaders focusing on improving customer retention and loyalty over the next year, now is the time to measure how well your personalization efforts are working.

Key Performance Indicators (KPIs)

Metrics are the backbone of evaluating personalization success. While basic numbers like enrollment rates track participation, more meaningful insights come from metrics like customer lifetime value (CLV) and repeat purchase frequency. Research shows that increasing customer retention by just 5% can boost profits by 25% to 95%, making CLV a vital indicator of long-term success. Additionally, monitoring repeat purchases, average order value, and engagement rates across customer segments can help identify the most impactful personalization strategies.

Engagement metrics also reveal how effectively your rewards resonate. For example:

- Active participation rates measure the percentage of customers earning or redeeming rewards.

- Redemption rates confirm whether rewards are driving genuine engagement.

- Breakage rates (unused points) might point to issues with your reward offerings or their perceived value.

The following table outlines key loyalty program metrics and their significance:

| Loyalty Program Metrics | Formula | Why It Matters |

|---|---|---|

| Program Enrollment Rate | (Loyalty members ÷ Total customers) × 100 | Measures how many customers join the program. |

| Active Member Rate | (Customers earning or redeeming rewards ÷ Total customers) × 100 | Tracks active participation in the program. |

| Redemption Rate | (Points or rewards redeemed ÷ Points or rewards issued) × 100 | Indicates if rewards are engaging enough to redeem. |

| Breakage Rate | (Expired points ÷ Issued points) × 100 | Highlights potential issues with reward value or appeal. |

| Program Revenue Percentage | (Revenue from loyalty members ÷ Total revenue) × 100 | Shows the financial impact of loyalty members. |

For intangible benefits, tools like surveys, Net Promoter Scores, and sentiment analysis provide valuable insights into customer satisfaction.

Regular Data Analysis and Updates

Measuring KPIs is just the beginning. To stay relevant, regular data analysis is essential, whether it’s weekly, monthly, or quarterly. As customer behavior shifts, ongoing analysis helps identify trends and adjust strategies in real-time.

Cohort analysis is especially useful for tracking loyalty over time. For instance, new customers often have lower repeat purchase rates initially, while long-term customers tend to deliver higher CLV. This insight allows businesses to design tailored rewards for onboarding new customers and retaining loyal ones.

Analyzing loyalty across different channels – such as websites, mobile apps, and physical stores – can reveal your most valuable customer segments. Further breaking down data by location or demographics provides additional clarity on how preferences vary.

A great example of this is Vietnam-based retailer Canifa. By using CleverTap’s analytics platform, the company achieved a 20% increase in retention rates and a 7% rise in revenue per user.

"Loyalty points represent the company’s financial reserve to the business." – Pawel Dziadkowiec, Loyalty Expert

Integrating data from multiple sources – like purchase history, browsing behavior, and customer feedback – creates detailed customer profiles. Feedback loops that automatically update personalization strategies based on customer actions ensure your approach remains effective.

Comparing Different Approaches

Testing is key to refining personalization strategies. A/B testing allows you to compare different approaches and identify what works best. With 72% of customers engaging only with personalized messages and 63% abandoning purchases when personalization falls short, fine-tuning your tactics is critical.

Comparing loyalty program members with non-members can also help optimize marketing strategies and product recommendations. Benchmarking both internal performance and industry standards gives a clearer picture of where improvements can be made.

Real-world examples highlight these methods in action. Starbucks, for instance, uses targeted in-app campaigns to boost rewards program enrollment by educating users about benefits and redemption options. Walmart leverages location data to deliver personalized weekly deals through push notifications, tailoring promotions to regional engagement trends.

Taking a long-term view is just as important as tracking immediate results. While metrics like emotional loyalty and brand advocacy may take time to develop, their impact on business growth can be significant. By focusing on long-term indicators – such as CLV, incremental sales, engagement rates, and churn reduction – you can consistently refine your personalization efforts and align them with your broader business goals.

Conclusion: Key Points for Personalizing Rewards

Personalized rewards aren’t just a nice-to-have – they’re a proven driver of business success. Companies that implement personalized rewards strategies see an average 6.4% increase in annual revenue, compared to just 3.4% for those who don’t. On top of that, 71% of consumers now expect personalized interactions, and 76% feel frustrated when such experiences are missing. These numbers highlight just how critical personalization has become in today’s marketplace.

At the heart of effective reward personalization is the ability to use customer insights to create meaningful connections. For example, 78% of consumers are more likely to engage with rewards that reflect their interactions with your brand. This underscores the importance of segmentation and data-driven strategies, as discussed earlier.

Technology is another key enabler. Platforms like meed simplify the process of creating personalized loyalty programs with features like digital stamp cards, QR code rewards, and seamless integration with Apple and Google wallets. Not only is the platform accessible – it’s free for up to 50 members, with advanced tools available for $490 per year – making it a cost-effective solution for businesses of all sizes.

To ensure long-term success, it’s vital to track and refine your approach over time. Metrics like customer lifetime value, redemption rates, and engagement levels across various customer segments can provide valuable insights. Personalization, when done right, can significantly enhance both customer loyalty and revenue.

Equally important is maintaining customer trust. Transparency about data collection practices, adherence to privacy regulations, and giving customers control over their information are non-negotiable. When businesses strike the right balance, personalized rewards benefit everyone – customers enjoy tailored experiences, while companies build stronger, lasting relationships. In fact, advancing to top-tier personalization could unlock more than $1 trillion in value across U.S. industries.

To get started, focus on understanding your customers, adopting the right tools, and continuously refining your strategy based on data and feedback. With platforms like meed making loyalty programs more accessible than ever, now is the perfect time to elevate your customer relationships through personalization. By applying these principles, businesses can deepen connections and achieve sustainable growth.

FAQs

How can businesses collect customer data for personalized rewards while staying compliant with privacy laws like GDPR and CCPA?

To comply with privacy regulations like GDPR and CCPA, businesses need to focus on being upfront and obtaining clear customer consent. Start by explaining exactly what data you’re collecting, why you need it, and how it will be used. Make sure to get explicit permission before gathering any personal information.

Keep data collection limited to only what’s absolutely necessary for creating tailored rewards. Safeguard customer information with strong encryption, both when storing it and during transmission. Tools like consent management platforms can help you keep track of and document permissions effectively. By taking these actions, businesses can maintain trust, meet legal requirements, and still provide personalized rewards that matter to their customers.

How can businesses use customer feedback to improve personalized rewards programs?

To make rewards programs more tailored and effective, businesses should focus on gathering and analyzing customer feedback. By understanding what customers truly value, companies can design rewards that feel more meaningful and relevant, which in turn strengthens loyalty.

Inviting customers to share their thoughts through surveys, reviews, or direct feedback opens the door to valuable insights. Acting on this feedback allows businesses to fine-tune their rewards, ensuring they align with customer preferences and stand out as engaging. When rewards reflect what customers actually want, it not only boosts satisfaction but also fosters lasting connections with them.

How can businesses use customer segmentation to create personalized rewards and build loyalty?

Businesses can make the most of customer segmentation by organizing customers into groups based on things like spending patterns, engagement levels, preferences, or purchase history. This strategy helps companies create rewards that feel more personal and meaningful to each group, such as exclusive discounts, early sale access, or customized digital offers.

Digging into customer data allows businesses to uncover what drives each segment, enabling them to design rewards that resonate on a deeper level. These tailored rewards not only improve customer satisfaction but also encourage higher engagement and loyalty over time, leaving a lasting impression and making your program stand out.