Loyalty programs are a great way to build customer relationships, but they also come with serious data privacy challenges – especially for businesses operating across multiple locations. Handling sensitive customer data like personal details, purchase history, and location tracking requires strict safeguards to avoid breaches, maintain compliance with laws like the CCPA, and preserve customer trust.

Key takeaways:

- Multi-location businesses face higher risks due to inconsistent data handling, varying technology systems, and expanded breach exposure.

- Privacy laws differ by state, making a unified compliance strategy essential.

- Centralized loyalty software simplifies privacy management, offering features like role-based access controls, encryption, and automated privacy request handling.

- Transparency with customers about data use and offering clear consent options builds trust and reduces privacy concerns.

How to Design a Privacy-First Loyalty Program (Without Breaking the Law)

Data Privacy Risks in Multi-Location Loyalty Programs

Multi-location loyalty programs create a web of interconnected data streams, which significantly increase privacy risks. Recognizing these risks is crucial for implementing effective protections. Let’s take a closer look at the types of customer data involved and the challenges posed by operating across multiple locations.

Types of Customer Data Collected

Loyalty programs today gather far more than just basic contact details. As businesses aim to better understand their customers, the scope of data collection has grown substantially.

- Personal identification data: This includes foundational details like names, phone numbers, email addresses, and birthdates. Many programs also request demographic specifics such as age, gender, and household income during sign-up.

- Transaction and purchase data: This category holds immense value for businesses. Every transaction generates a wealth of information – items purchased, quantities, prices, payment methods, and timestamps. These insights highlight buying patterns, brand preferences, and seasonal trends, shaping targeted marketing strategies and inventory decisions.

- Location and behavioral data: Mobile apps and digital tools add another layer of complexity. They track store visits, time spent in-store, and even movement patterns. Online interactions, like app usage, email engagement, and website activity, further expand the data trail.

- Biometric and device data: Modern programs increasingly collect device identifiers, IP addresses, and biometric data (like fingerprints) for authentication purposes. QR code scans also log when and where customers interact with promotional materials.

Each customer profile combines numerous data points, creating intricate datasets that require robust privacy measures. The variety and volume of data collected make it even more challenging to ensure consistent protection, especially across multiple locations.

Risks of Multi-Location Operations

Managing data privacy risks becomes significantly more complex when businesses operate across multiple locations. The interconnected nature of these operations introduces several challenges:

- Inconsistent data handling and staff training: Different locations may interpret privacy policies in varying ways. For instance, one store might limit data collection to essentials, while another gathers detailed demographic profiles. This inconsistency can lead to compliance gaps and customer confusion. Moreover, disparities in employee training across locations can result in uneven practices for data handling, consent collection, and breach response.

- Expanded breach exposure: Each additional location increases the potential entry points for cyberattacks. With more employees managing sensitive data, the risk of human error or malicious activity grows. A breach at one location can compromise the entire network, jeopardizing the central customer database.

- Inconsistent technology systems: Varying point-of-sale systems, networks, or mobile devices across locations can introduce vulnerabilities. If these systems don’t follow uniform security standards, they can create weak spots that impact the entire operation when connected to centralized databases.

- Regulatory compliance challenges: Operating in multiple states adds layers of complexity to compliance. For example, a business with locations in both California and Texas might adopt California’s stricter CCPA standards across the board to avoid gaps and ensure consistency. However, this approach requires careful coordination and enforcement.

- Data transfer vulnerabilities: Moving customer information between locations or to central servers introduces additional risks. Weak points in these transfers can expose sensitive data to interception or loss.

The interconnected nature of multi-location loyalty programs means that a single privacy failure can ripple across the entire network. This can lead to regulatory scrutiny, customer lawsuits, and severe reputational harm – consequences that no business can afford to overlook.

Legal Requirements for Loyalty Programs

Running loyalty programs across multiple locations in the U.S. means navigating a patchwork of state privacy laws. Without a single federal standard, businesses must adapt their data privacy practices to meet diverse state regulations.

U.S. Privacy Laws for Loyalty Programs

Several states have introduced privacy laws granting consumers key rights over their personal information. These rights often include access to their data, the ability to request corrections or deletions, and, in some cases, explicit consent before sensitive data is processed. One prominent example is the California Consumer Privacy Act (CCPA), which set an early precedent by requiring clear disclosures about data collection and use. It also gives consumers the ability to access, correct, or delete their data. Other states have followed suit with similar laws, though the specifics – such as consent requirements and restrictions on sharing data with third parties – can vary.

This regulatory landscape underscores the importance of transparency. Businesses need to go beyond vague privacy policies and clearly outline what data is collected, how it’s used, and whether it’s shared with third parties. This level of clarity is not just a legal obligation but also a way to build trust with consumers.

Compliance Across Multiple Locations

For businesses operating in multiple states, adopting a unified approach to compliance is critical. Implementing the strictest applicable standard across all locations can simplify operations, ensuring consistency in data management, staff training, and internal controls.

Staying compliant requires proactive measures, such as regular policy updates, thorough documentation, and adaptable systems. This dynamic approach helps businesses navigate changing regulations while reinforcing consumer trust. A strong, centralized compliance strategy not only reduces legal risks but also strengthens the foundation for loyalty programs that prioritize privacy and transparency.

How to Manage Data Privacy in Multi-Location Loyalty Programs

Handling data privacy in loyalty programs across multiple locations requires a well-structured strategy. With 48% of customers walking away due to privacy concerns and 19% stopping their patronage after a breach, it’s clear that protecting customer data isn’t optional – it’s essential. In fact, 73% of consumers prefer loyalty programs that prioritize privacy. These numbers highlight the importance of safeguarding customer data while complying with legal requirements and building trust through transparency.

Customer Consent and Transparency

Trust begins with open and straightforward communication about how customer data is collected, used, and protected. A staggering 85% of consumers want to understand a company’s data protection policies before making a purchase decision. This means your privacy policy shouldn’t be buried in legal jargon – it needs to be clear and accessible.

Your privacy notices should break down, in plain language, the types of data you collect – such as purchase history, contact details, or location data – and explain why you need it and how it will be used. Be upfront about whether this data will be shared with third parties or used for purposes beyond the loyalty program, like marketing.

Offer customers the ability to choose how their data is used. For example, they might agree to receive personalized discounts but decline location-based promotions. This level of choice respects individual preferences while still allowing you to deliver value through tailored offers.

Make it simple for customers to update their preferences or withdraw consent at any time. Whether they want to access their data, request corrections, or delete their information, the process should be straightforward and consistent across all your locations. In many cases, this isn’t just good practice – it’s a legal requirement.

Another critical step is training your employees on privacy policies. Human error is responsible for 88% of security breaches, so ensuring your team understands and follows best practices can significantly reduce risks.

Transparent consent processes lay the foundation for implementing strong technical safeguards, which are essential when selecting technology partners who align with your commitment to data privacy.

Secure Data Handling and Vendor Selection

Protecting customer data goes beyond consent – it requires robust technical measures and careful selection of technology vendors. Choosing the right partner is crucial, especially for multi-location operations where consistency is key.

When evaluating vendors, look for industry-standard certifications like ISO 27001, SOC 2 Type 2, PCI-DSS, and GDPR compliance. These certifications indicate that the vendor has rigorous security protocols in place and undergoes regular third-party audits.

Encryption is another must-have. Ensure that your vendor encrypts customer data both at rest and in transit. It’s also worth asking detailed questions about their encryption standards and how they manage encryption keys.

You should retain full ownership of your customer data throughout your relationship with the vendor. Confirm that their security practices remain consistent across all regions and jurisdictions where your loyalty program operates.

Modern fraud detection capabilities are also essential. Look for platforms that use AI-driven tools to identify unusual activity patterns while protecting legitimate customer data.

To ensure you’re selecting the right vendor, create a detailed RFP outlining your security and privacy needs. Include questions about vulnerability assessments, penetration testing, and how they handle incidents. A trustworthy vendor will be transparent and provide thorough documentation about their security measures.

Additionally, check how the vendor manages sub-processors involved in handling your data. Strong oversight is critical to maintaining security at every level.

Finally, as your business grows and your loyalty program expands, your platform must scale without compromising security. Whether you’re adding new locations or introducing new features, your privacy controls should remain consistent and reliable across your entire operation.

sbb-itb-94e1183

Using Centralized Software for Data Privacy

Managing loyalty programs across multiple locations can be a logistical headache, especially when it comes to maintaining consistent data privacy standards. This is where centralized software steps in as a game-changer. Instead of juggling separate systems at each location – each with its own vulnerabilities and compliance hurdles – a unified platform allows for streamlined privacy management and tighter control.

But this isn’t just about making life easier. Centralized systems solve a major issue: data silos. When customer information is scattered across various databases with inconsistent security measures, it’s tough to give customers a clear view of their data or respond promptly to privacy requests. Let’s dive into the key security features these platforms bring to the table.

Key Privacy and Security Features

Modern centralized loyalty platforms come equipped with robust features that would be challenging to implement on a location-by-location basis:

- Role-based access controls: Employees only see the data they need. For example, a cashier handling transactions won’t have access to sensitive customer details, while a regional manager might view broader analytics without drilling into personal contact information.

- Audit logs: These provide a detailed record of who accessed specific data and when. This level of transparency is essential for compliance investigations and helps quickly identify any unauthorized access attempts.

- Data retention policies: Set it and forget it. Instead of manually managing when to delete outdated customer records at each location, the system enforces consistent data lifecycle management based on your privacy policies and legal requirements.

- Automated privacy request handling: Customers can easily request access, corrections, or deletions of their information through a single channel. The system then processes these requests across all locations, eliminating the need for customers to contact individual stores.

- Encryption and secure data transmission: Customer information is protected as it moves between locations and your central database, reducing risks associated with unsecured methods like email or file sharing.

- Customizable consent management: Privacy preferences are tailored to the customer. For instance, someone may agree to receive email promotions but decline SMS notifications. These preferences are automatically applied across all your locations.

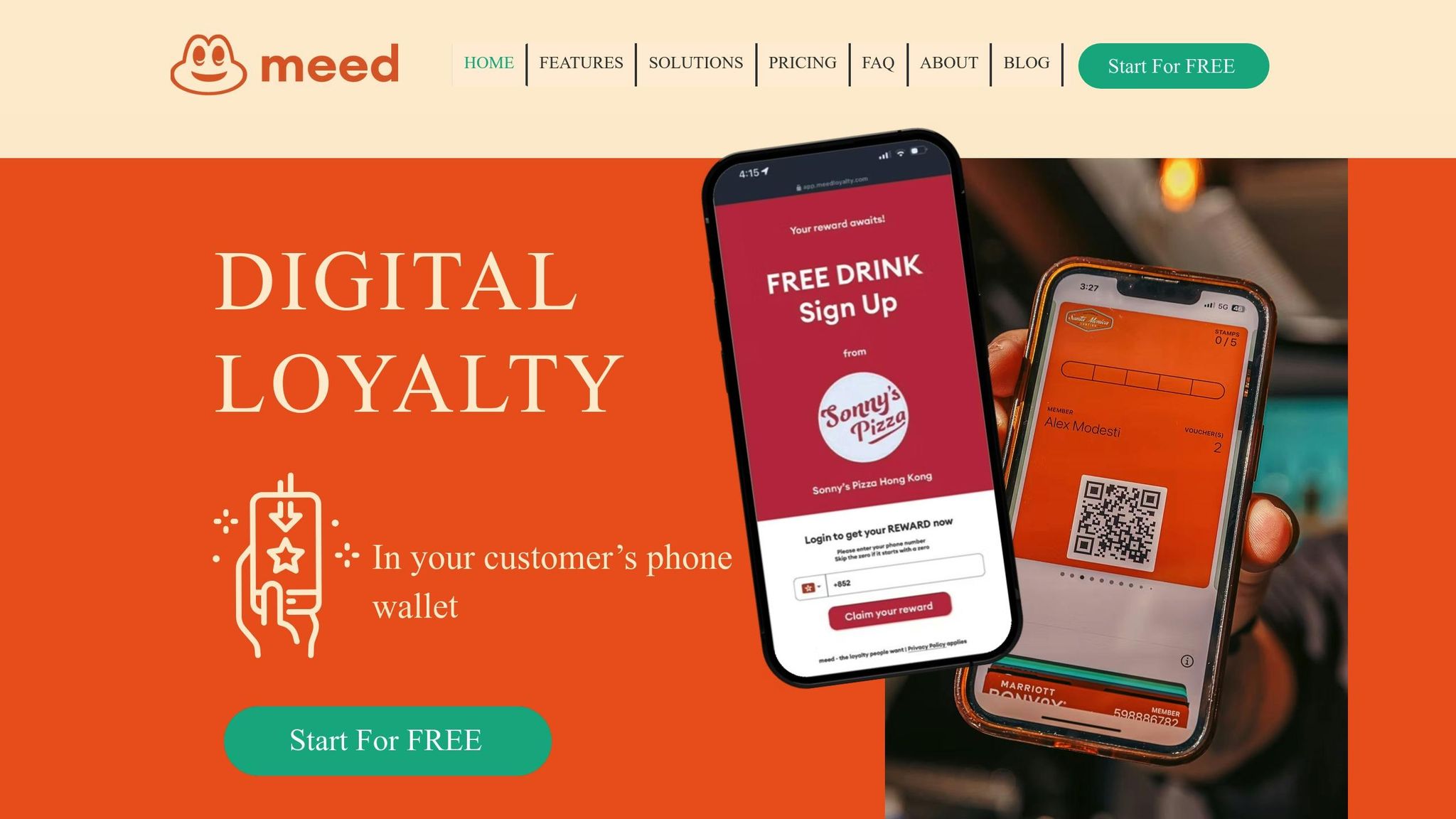

How Meed Solves Multi-Location Privacy Challenges

Meed takes these features a step further, offering solutions that simplify privacy management across multiple locations while allowing for location-specific flexibility. Whether you’re running a small chain or a large network, Meed ensures consistent handling of customer data.

The platform’s unified customer profiles make privacy preferences seamless. If a customer opts out of location-based promotions at one store, that choice is instantly reflected across the entire network. This prevents situations where customers receive unwanted communications from other locations within the same business.

With centralized analytics and reporting, you get a comprehensive view of your privacy compliance across all locations. This makes it easy to track what data is being collected and ensure everyone is adhering to the same standards. Spotting potential compliance issues becomes much simpler.

Meed also integrates with Apple and Google wallets, leveraging their advanced security infrastructure. Customer payment and loyalty data are protected by the same high standards used for banking apps and other sensitive mobile applications.

Through QR code-based interactions, customers can engage with your loyalty program without sharing excessive personal details. This reduces the amount of data you need to store, lowering your privacy risks.

The platform’s multi-program support is ideal for businesses with diverse operations. For example, a restaurant chain and its catering division might have different data collection needs, but both can operate under the same overarching privacy framework.

Finally, Meed’s scalable architecture ensures that adding new locations is hassle-free. New sites automatically inherit your existing privacy controls and compliance measures, so there’s no need for separate setups or additional training. Everything works seamlessly from day one.

Best Practices for Maintaining Privacy Compliance

Staying compliant with privacy regulations isn’t a one-and-done task – it’s an ongoing process. As your multi-location loyalty program expands and privacy laws shift, regular updates and employee training become critical. These steps not only help you stay on the right side of the law but also build trust with your customers.

Policy Reviews and Staff Training

Privacy policies need to evolve alongside changes in data practices and legal standards. Conducting quarterly reviews is a smart way to spot any gaps or inconsistencies in how customer data is collected, stored, or used. During these reviews, take the time to perform a thorough data inventory. This helps you understand exactly what information you’re holding, where it’s stored, and who has access to it.

Employee training is just as important. Regular sessions ensure your team knows how to handle data securely and follow the latest privacy policies. These trainings reinforce a consistent approach to data protection across all your locations. When combined with centralized management systems, these efforts create a seamless framework for privacy compliance.

Handling Customer Data Requests

Responding to customer data requests promptly and transparently is a cornerstone of privacy compliance. Your privacy policies should clearly outline how customers can access, update, or delete their personal information. Standardize the process for handling these requests across all your locations to ensure consistency. Keeping detailed records of these interactions is also crucial for demonstrating compliance during audits.

Conclusion: Building a Privacy-First Loyalty Program

To create a thriving multi-location loyalty program, prioritizing data privacy isn’t just a legal necessity – it’s a chance to build trust and stand out in a privacy-focused world. Businesses that embrace compliance as an opportunity, rather than a hurdle, are better positioned to succeed.

As discussed earlier, the backbone of a privacy-first loyalty program lies in three key pillars: clear communication, strong security measures, and consistent practices. Customers should always know what data you’re collecting, why you need it, and feel confident that their information is safeguarded with top-tier security protocols across all locations.

Centralized platforms, like Meed, play a crucial role here. They streamline privacy management by offering automated tools and unified customer profiles, ensuring that preferences and data are updated seamlessly across locations. This approach not only simplifies compliance but also makes it easier to train staff and handle customer data requests efficiently.

Investing in data privacy doesn’t just keep you compliant – it builds loyalty. When customers trust your brand with their personal information, they’re more inclined to engage with your program, share accurate details, and participate in tailored offers. This trust fosters deeper connections, encouraging them to recommend your business to others. The result? Stronger customer engagement and increased revenue. Regularly reviewing policies, training staff, and responding quickly to customer concerns ensures you stay ahead of privacy laws and customer expectations.

FAQs

How can businesses with multiple locations maintain compliance with different state privacy laws in their loyalty programs?

To stay compliant with the patchwork of state privacy laws, businesses should implement centralized data privacy policies that meet the most stringent regulations – like California’s CCPA. It’s also crucial to routinely review and update these policies as new laws emerge.

Here are some additional steps businesses can take:

- Offer ongoing privacy training to employees to promote consistent and informed practices.

- Create and maintain clear, easy-to-understand privacy notices for customers.

- Leverage centralized tools to track legal changes and ensure compliance across all states.

Taking these proactive measures not only simplifies the compliance process but also helps businesses foster trust with their customers.

What features should centralized loyalty software include to ensure data privacy across multiple locations?

Centralized loyalty software must come equipped with essential features to protect customer data and maintain privacy compliance across all your business locations. Among these, secure data management tools play a crucial role in organizing and safeguarding customer information. Features like consent tracking ensure that customer preferences are honored, while privacy impact assessments help identify and address any potential risks tied to data handling.

On top of that, strong compliance monitoring ensures the software stays aligned with relevant privacy regulations, offering consistent protection for customer data regardless of where it’s collected. These capabilities not only strengthen data security but also foster customer trust by making their privacy a top priority.

How can businesses build trust with customers by communicating their data privacy practices in loyalty programs?

To earn customer trust, it’s essential for businesses to provide a clear and straightforward privacy policy. This policy should explain exactly how customer data is collected, used, and safeguarded. Make sure this information is easy to locate within your loyalty program platform. Being transparent is crucial – clearly state the purpose of data collection and specify who has access to it.

On top of that, give your customers control over their personal information. Include options such as opting out of data sharing or customizing privacy settings. These choices not only respect their preferences but also demonstrate your dedication to protecting their privacy. By focusing on transparency and giving customers control, you can strengthen trust and build lasting loyalty.